Our Philosophy

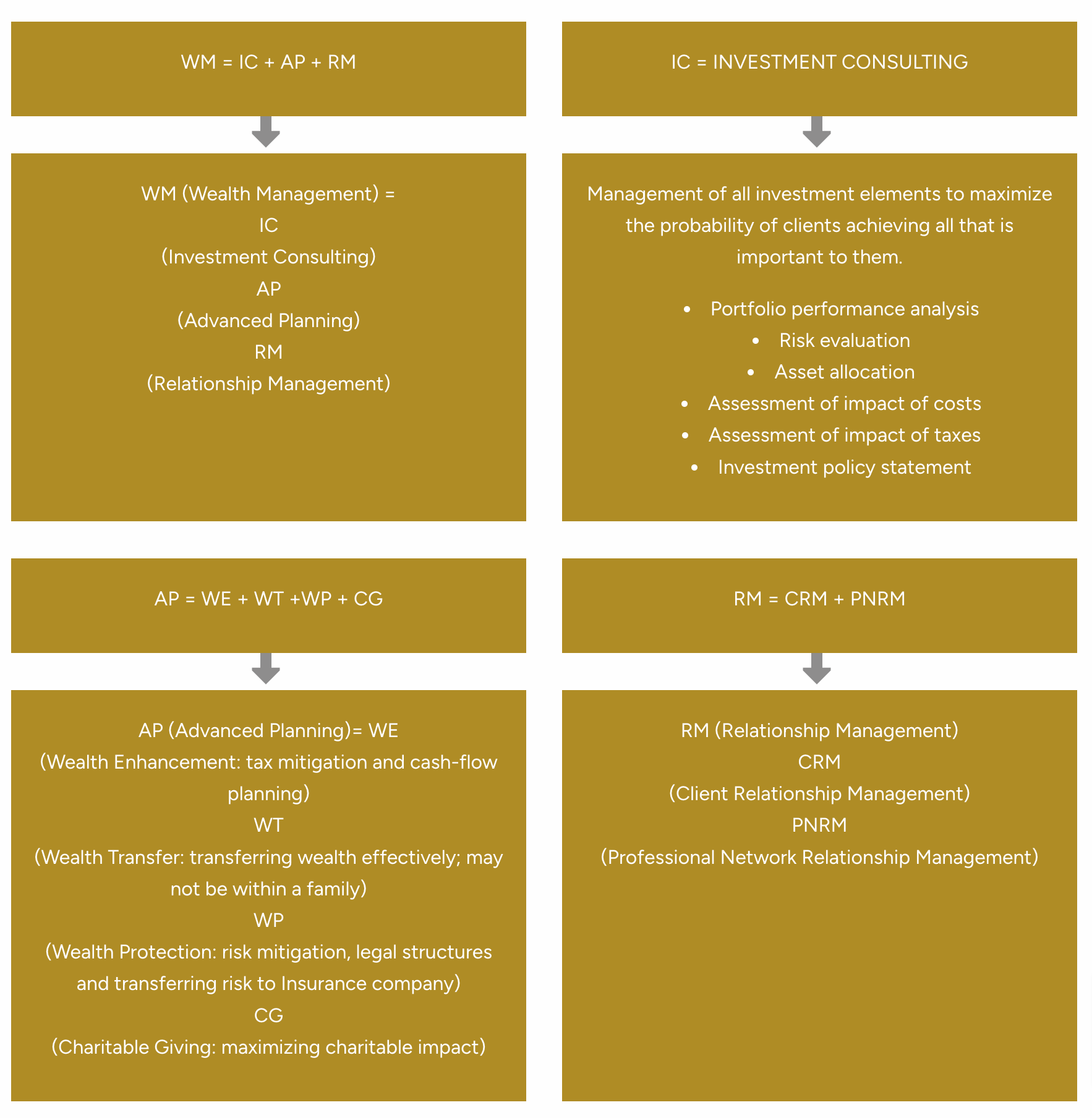

We distinguish ourselves as wealth managers, a distinction that sets us apart from traditional financial advisors. Allow us to shed light on the difference.

While the term "wealth management" is commonly used by many advisors, it's crucial to recognize that most financial advisors are generally investment specialists with a focus on portfolio management rather than comprehensive, big-picture planning strategies.

As a Certified Financial Planner™, Pete Blackwell seeks to elevate service to bring a higher level of scrutiny to your unique financial situation. Drawing on our extensive quarter-century investment management experience, we combine these areas of expertise to provide not only in-depth holistic advice but also customized financial strategies tailored precisely to your individual circumstances.

The outcome is a markedly deeper level of advice and service compared to what some advisors may offer. Our commitment lies in delivering a comprehensive approach that goes beyond conventional portfolio management, ensuring that your financial strategies align seamlessly with your broader life goals and aspirations.